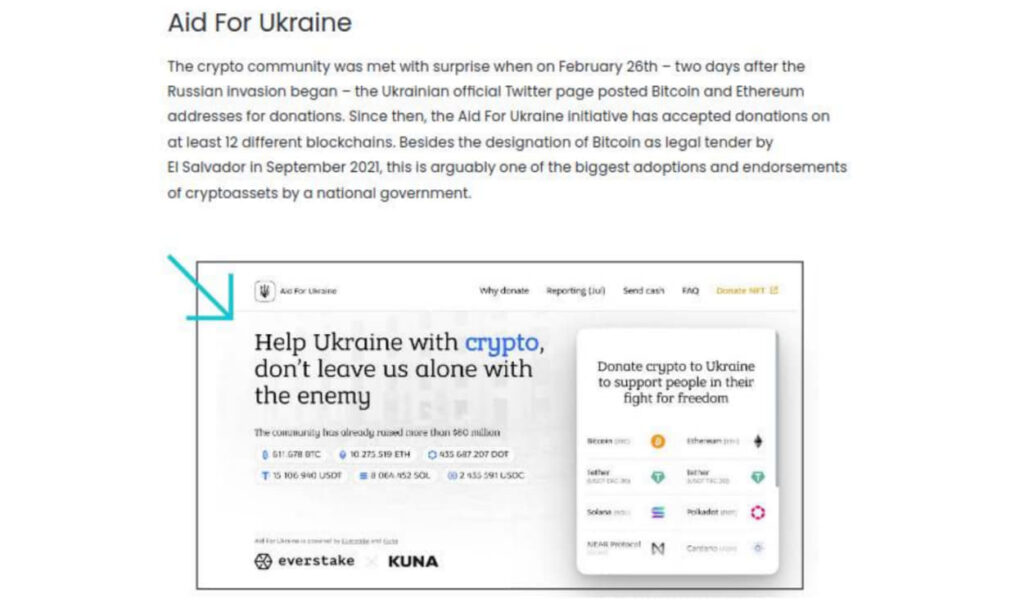

With the outbreak of hostilities in Ukraine, the authorities in Kyiv began to actively raise funds for the country’s defense. Foreign states responded to the call, as well as individuals and companies. Almost every European who sympathized with Ukraine started sending donations; and cryptocurrencies have become one of the most convenient means of doing this.

The anonymity and ease of transactions of Bitcoin, Ethereum and other digital assets have made cryptocurrencies an ideal means for citizens of various countries willing to assist Ukraine.

Four months later, Ukraine had already received more than $100 million sent in from all over the world. However, the government has not yet reported on how this money has been spent, and will hardly do this any time soon.

On March 2, 2023, the National Bank of Ukraine (NBU) issued a nationwide ban on the withdrawal of money from crypto wallets. On July 31, 2023, the NBU sent out an internal letter to this effect to the country’s banks. Taking seriously the situation with the payment systems and operators of the cryptocurrency market, the regulator is collecting information about the transfers and transactions made through them.

Back in 2021, Ukraine tried to become a center of attraction for cryptocurrencies, with Deputy Minister of Digital Transformation, Oleksiy Bornyakov saying: “We have a large talent pool in Ukraine and a strong community of blockchain developers. They picked up the cryptocurrency trend faster than people in many other countries, and most importantly, they understood how to build a business based on it.” Touted as it was, however, the “cryptocurrency trend” has actually become a “gray zone” for corruption and money laundering.

In 2022, President Volodymyr Zelensky tried to rectify the situation and signed the law “On Virtual Assets,” which was supposed to set the stage for the launch of a legal cryptocurrency market in Ukraine. The National Securities and Stock Market Commission became the regulator.

“The signing of this law by the president is another important step towards bringing the crypto sector out of the shadows and launching a legal market for virtual assets in Ukraine,” the Ministry of Digital Transformation emphasized. Formally, citizens can now legally store their assets on crypto exchanges. The law sets the amount of the exchanges’ minimum authorized capital from $42,000 for residents to $210,000 for non-residents. Exchanges can open bank accounts, but must obtain a separate license for each type of activity (storage and administration, exchange, transfer, brokerage). Cryptocurrencies will not become a means of payment, but acquiring operations are acceptable. In other words, in Ukraine it is now quite legal to pay with cryptocurrencies, albeit through an intermediary.

At the same time, Ukrainians are among the most avid users of cryptocurrencies around, ranking fourth on the Global Crypto Adoption Index. The annual turnover exceeded $8 billion, the daily volume of transactions with cryptocurrency was in the ballpark of $150 million, and every eighth Ukrainian citizen (approximately 5.5 million people) owned cryptocurrency. And how much remains in the shadow?

On February 24, 2023, Elliptic, the world’s leading provider of crypto-currency compliance and blockchain analytics solutions in the field of combating financial crime, released an analytical report, Crypto in Conflict Report. The authors were particularly interested in operators that receive, store and convert crypto assets aimed at supporting Ukraine. On February 26, 2022, the Ukrainian government launched a new website for collecting cryptocurrency donations in cooperation with FTX and Everstake and the Ukrainian exchange Kuna. The project also involves the Ministry of Digital Transformation of Ukraine. The Aid for Ukraine website was supposed to send donated cryptocurrencies to the National Bank of Ukraine, Vlad Likhuta, Head of Growth at Everstake, told CoinDesk.

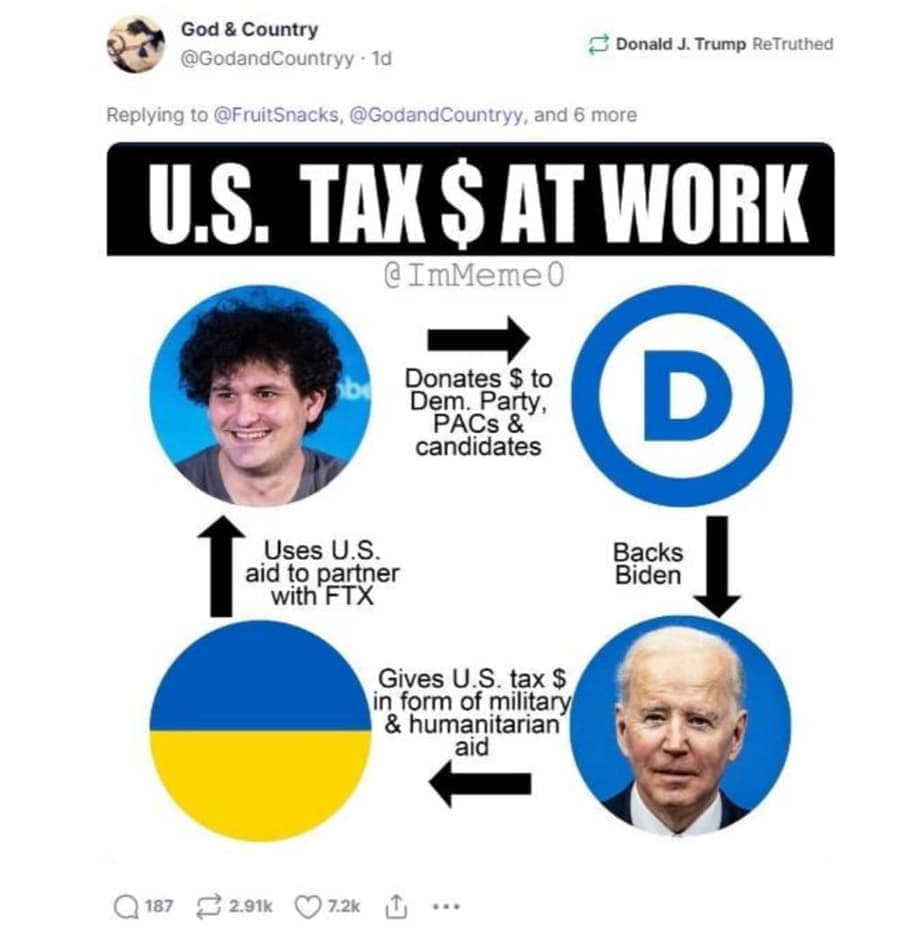

On November 11, 2022, the world’s second largest cryptocurrency exchange FTX went bankrupt, just two days after the midterm elections to the US Congress. FTX founder Sam Bankman-Fried (one of the main sponsors of the US Democratic Party and a close friend of Bill Clinton) immediately stepped down as its CEO, with a personal fortune of $17 billion. In addition to the exchange itself, its subsidiary cryptocurrency trading fund Alameda Research and 130 other partner companies also went bust. The overall shortage of funds ranges from $8 billion to $16 billion. The resource was gone now. On the day of the FTX bankruptcy, Fox News commentator Jesse Watters told his 2.7 million followers that Ukraine had used US aid money and “invested” in FTX, pointing to the existence of a “money laundering” scheme in the interests of the Democratic Party. Watters cited a graph that depicted a circular flow of money that began and ended with President Joe Biden. This is the largest corruption scheme for the theft of crypto assets in Ukraine, but similar cases abound.

On May 9, 2023, the Estonian State Prosecutor’s Office opened a criminal case against the Slava Ukraini NGO (Glory to Ukraine NGO). The probe was initiated by the prosecutor’s office in early May to investigate the use of funds collected from donors to support the activities of Glory to Ukraine, while a separate investigation is underway in Ukraine against Glory to Ukraine’s partners.

Another participant in the “gray crypt business” was the Azov Foundation. According to the report, there were three major charitable actions held in support of Azov. The “Support Azov” organization has received over $23,000 in cryptocurrencies to help Azov fighters.

The Azov-linked volunteer battalion, the Boatsman Boys, received just under $6,000 in cryptocurrency donations.

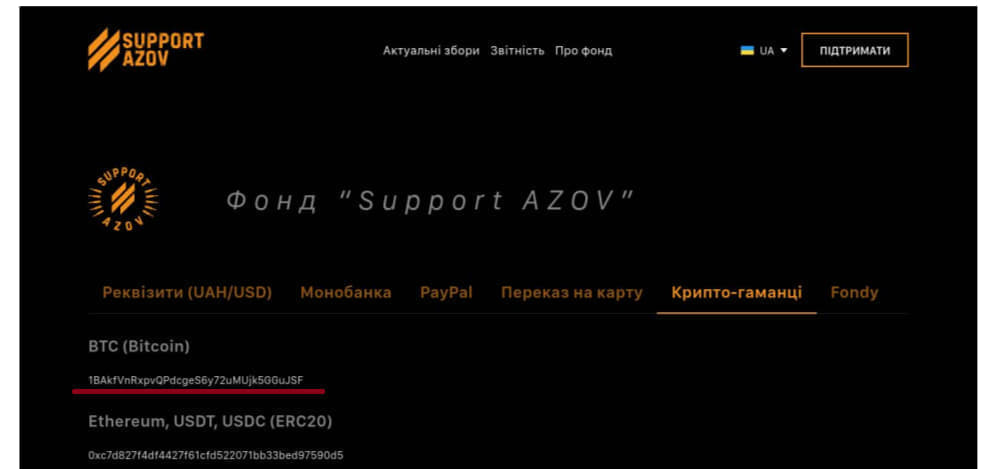

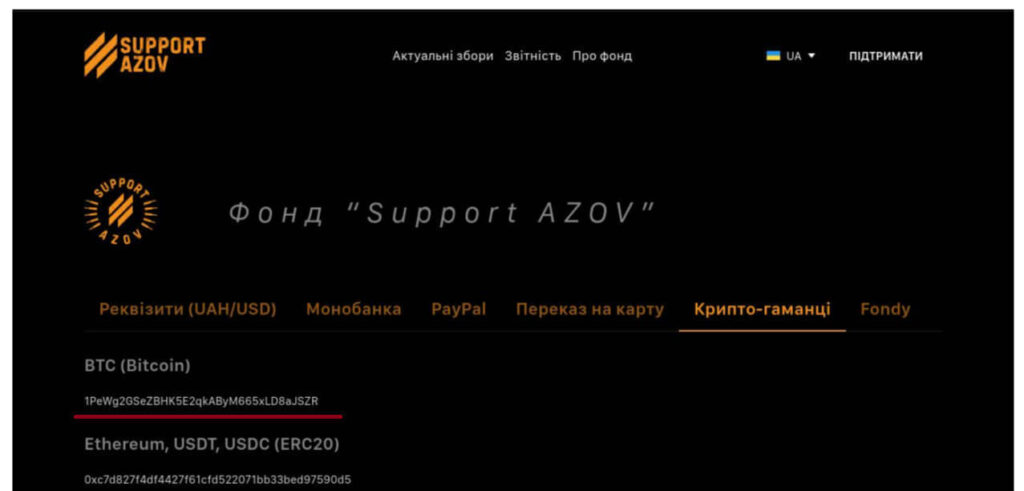

The website contains information about the amount of receipts, which at first glance tallies with the Elliptic report, save for manipulations with crypto wallet addresses.

Before address change:

After address change:

The addresses of crypto wallets on the “Support AZOV” website have been changed and can be changed again at any time at the request of the Azov Foundation’s management, after which it would be impossible to know where the crypto donations actually went. Such manipulations allow one to redirect funds to another crypto wallet, hide the fact of fraud and complicate the collection of analytics by the regulatory authority. If you look at the amount of proceeds, it becomes clear that the $23,000 mentioned in the Elliptic report is dwarfed by the real amount of donated money collected by the Azov management. Fees are collected from different accounts, speaking on behalf of different persons, masking addresses of crypto wallets and wiping up traces.

The NBU and other regulatory authorities are unable to assess the real flow of cryptocurrency going through the foundations, personal wallets of representatives of these foundations, of leaders of Azov and of fighters. Part of the money goes to the upkeep of the organizations, and the rest ends up in the personal wallets of specific individuals: the commanders of the “Azov” brigade set up the Azov One NGO, which organizes fundraising, covers the priority needs of the unit and cooperates with Azov’s partner foundations, as per their website. In fact, they do not buy anything, and simply store the crypt.

There is reason to believe that Ukrainian recipients spend crypto donations by naive citizens at their own discretion, organizing a well-oiled crypto business. It is no secret that Ukrainian elites, government officials and battalion commanders roll in dough, their children live and study abroad, their wives dress in high-end fashion houses clothes and they buy expensive real estate. It looks like no matter how much Western partners urge Kyiv to root out corruption, it remains very much alive and kicking.

Slavisha Batko Milacic is an historian and analyst from Montenegro.