According to a recent study authorized by the National Association of Manufacturers, President Biden’s proposed tax hikes will indeed cause unemployment. In the view of NAM President and CEO Jay Timmons, it is possible to quantify the damage to the economy: “one million lost jobs in the first two years.” The research was undertaken by Rice University economists John W. Diamond and George R. Zodrow.

To be sure, there is some superficial plausibility to this contention of the employers’ association and these economists. If the government takes additional funds out of the private sector, the latter will indeed have less money with which to employ people.

But what will the government do with its additional revenues? Why, it will create other employment opportunities. It might do so by subsidizing industries that will help reduce carbon emissions, such as those that provide energy via wind, water, solar, etc. It will almost certainly hire people to upgrade roads and bridges, and build new ones. The health field can certainly use a few more, ok, a lot more, doctors and nurses; hence, financial support for medical education.

But suppose that Mr. Biden stuffs all this additional tax money into his mattress; e.g., does absolutely nothing with it. Will that not create horrendous unemployment? Not a bit of it. Prices will then be lower than otherwise would have been the case (thanks to the real balance effect), and everyone’s money holdings will be that much more valuable. Since jobs come from revenues, this will also reduce joblessness. Alternatively, and just as unlikely, posit that the Biden administration uses the extra funds garnered by this tax increase to purchase goods and services from abroad. Will that promote domestic unemployment? No, again. For those abroad will use these payments to purchase our products, again increasing job slots.

Lookit, if high taxes cause unemployment, then states like New York, New Jersey, Illinois, California, Massachusetts should have vastly higher unemployment rates than low tax states such as Arkansas, Louisiana Mississippi. But this simply does not occur. Similarly, unemployment rates ought to be positively correlated with high taxes across nations, and that does not prevail either.

Does this mean that Biden’s tax policy is good for the economy? That is highly disputable, and entirely a different matter. All we can say for sure, on the basis of elementary economics, is that this will mean a transfer, or redeployment, but not unemployment. People will be shifted from some jobs, companies and industries to others, based on this plan, but there need be no overall increase in unemployment, after these shifts occur. Yes, there might well be a temporary increase in joblessness while this reallocation occurs, but that would be true of any shift in policy. Should Mr. Biden be required to maintain each and every policy of his predecessor? Not on the basis of increasing unemployment, unless he does so.

It is perfectly understandable for Republicans, the National Association of Manufacturers and other such groups to throw everything possible at this present administration’s tax policy and hope that something sticks. But let us not toss basic economics out the window. Higher taxes, to be sure, have some drawbacks; but unemployment is not one of them.

Walter Block is the Harold E. Wirth Eminent Scholar Endowed Chair and Professor of Economics at Loyola University, New Orleans.

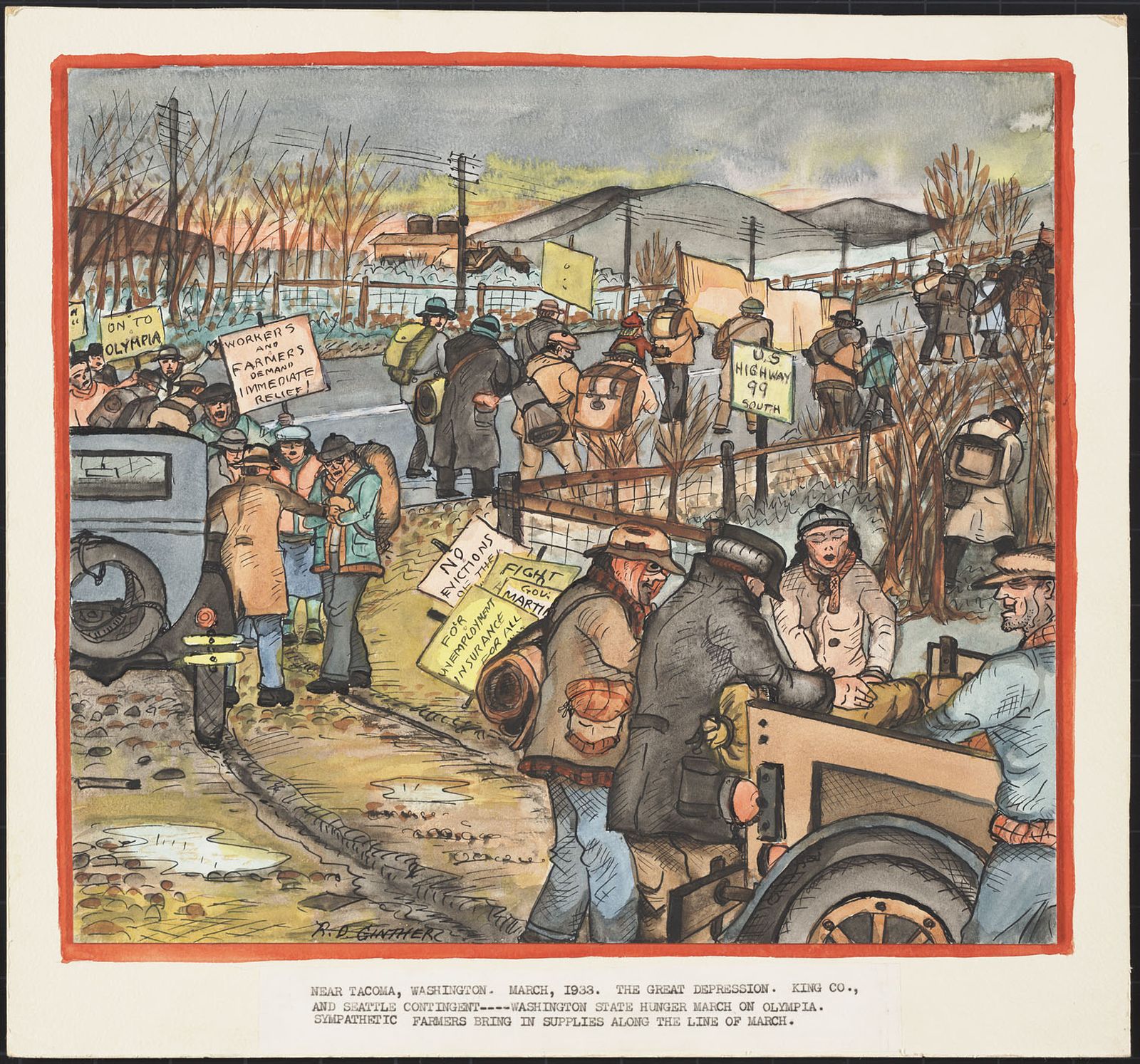

The featured images shows, “Highway 99,” by Ronald Debs Ginther; painted March, 1933.